Cryptocurrency Explained

In the past few weeks, there has been an uproar caused by a couple of politicians announcing aspirations to be paid in bitcoin as opposed to a traditional paycheck.

Just last Thursday, New York City mayor-elect, Eric Adams announced in a Twitter post that he would like his first three paychecks to be made in bitcoin when he is installed as mayor.

Adams wrote that “In New York, we always go big” and that New York City is going to be the “center of the cryptocurrency industry” in the upcoming years, describing the industry as “innovative” and “fast-growing”.

However, this recent announcement has sparked debate on whether or not the public or its officials should support cryptocurrency: is it the future of banking and trade, or an unreliable hub for scammers and criminal organizations that aim to take advantage of currency that is not regulated by a government?

But first, what is cryptocurrency?

Regardless of the specific type of crypto, cryptocurrency is essentially a digital currency that is minted with a cryptograph by private citizens instead of the traditional physical currency printed by a state through a national bank or treasury.

Once mined into existence, cryptocurrencies can also be traded across forms of money, and be purchased using traditional forms of currency along with other forms of crypto.

Many are drawn to cryptocurrency because there are few government restrictions, making it difficult for governments to track transactions; however, this “advantage” brings with it those who use cryptocurrency for illicit transactions such as scammers, extortionists, drug dealers, etc.

In addition to possessing an underground community of crypto-scammers, cryptocurrency in its nature fluctuates and is not as stable as currencies like the US Dollar or the Euro.

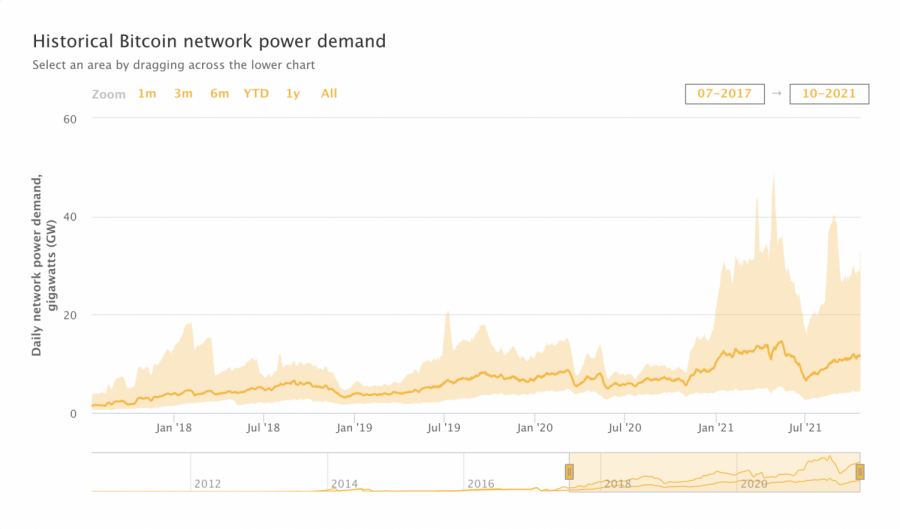

Despite these risks, many see cryptocurrency as a great investment because of its rapidly increasing value. However, while more than 76 million people as of August 2021 created bitcoin wallets to purchase cryptocurrency on blockchain.com, many are still unaware as to how crypto actually works, and what investing in it might mean for the environment. While many cryptocurrencies don’t have a huge environmental impact, those that use mining require massive amounts of energy and are negatively contributing to the climate crisis. While many forms of cryptocurrency don’t even allow for mining and thus don’t have such a large carbon footprint like Chia, IOFA, and Ethereum, those that do, encourage the use of high-tech computers which require a lot of energy to do their job.

Bitcoin, the most widespread cryptocurrency platform, consumed around 121.35 terawatt-hours (TWh or 3.6 x 1015 J per hour) of electricity as most recently reported by the BBC in 2021; this number is likely to continue increasing unless the value of bitcoin decreases tremendously. To put this into perspective, if Bitcoin were to be considered a country, it would be in the top 30 energy users worldwide, coming ahead of massive nations such as Argentina (121 TWh), the Netherlands (108.8 TWh), and the United Arab Emirates (113.20 TWh) according to the University of Cambridge’s Bitcoin Electricity Consumption Index. Suffice to say, bitcoin mining uses a great deal of energy, which is thought to be increasing the amount of CO2 emissions globally.

I know what you are thinking, it is only a couple of computers, how big of an impact can this actually have? In reality, it is not just a couple of desktops, but massive server farms that are working round the clock to mine for the digital currency. It is difficult to understand just how much energy 121.35 (TWh) actually is, but to put it into perspective, according to researchers at Cambridge, this accounts for 0.5 percent of the total consumed energy throughout the world. The thing is that the success of the currency depends on a high hash rate, which is dependent on high energy consumption.

Taking this into account, there are people that are opposed to the rise of cryptocurrencies such as Bitcoin because of the environmental impact; however, others see these alternative forms of money as the future. It is unclear whether these currencies are trying to become more sustainable or if they will continue on the current trend — increasing in both popularity and consumption. However, the very nature of cryptocurrency relies on a very dense energy source, and while this is taking our world and economy into the future, we must consider the cost of innovation.

Keeping Records of Crypto in the BlockChain

Since cryptocurrency does not exist in the physical world, there needs to be a way to verify who owns it, which is done in what is called a “blockchain”. A blockchain in itself is not a cryptocurrency; it is just a way to keep track of information. For example, blockchains are also used for healthcare records, property transactions, and other forms of sensitized data. Cryptocurrencies are one of many that utilize this technology except on a public network instead of a private one. In sum, cryptocurrencies are a currency within themselves, which transform this blockchain technology in order to deal with money.

Breaking this down into a popular analogy, a blockchain is basically a massive-shared google doc where everyone has edit-access. Similar to a doc, everyone who has had the file shared with them can access it, make comments, suggest edits, and see what everyone else is doing live. Going a step further, everyone can also see the revision history, just as everyone can see what has already been approved in a blockchain. No one can make a change without all the other ‘spectators’, or people on the document, seeing it; so all changes have to be correct or else they would get caught. This is exactly what a blockchain is: except instead of a google doc, it is a shared ledger that anyone on the network can access, and all the changes can be verified by everyone else in the network.

How Can You Mine for Cryptocurrency?

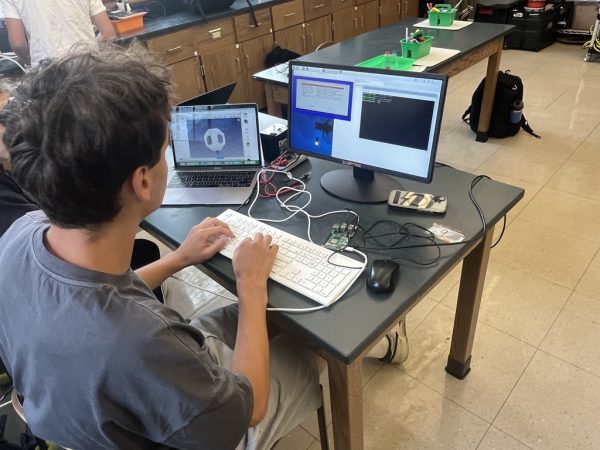

Continuing with the Google Docs analogy, mining for cryptocurrency is how all the edits get approved; basically a team of spectators that are paid for being the first one to check off a revision. Think of it as a game- the first one to make sure that the change is correct, wins the money. However, you would need to swap the analogy of approving a Google Docs edit for legitimizing a transaction, and your simple computer for a state of the art, not to mention an expensive, graphics processing unit (GPU) or an application specific integrated circuit (ASIC).

So what exactly does a ‘miner’ do? Many think that mining for cryptocurrency requires a lot of advanced mathematical calculations, but this is misleading as the math itself is not hard, but rather it’s simply being the first person to come up with a 64-digit number, called a hash. Continuing with the google docs analogy, this is comparable to how in order to approve an edit, you would need to enter this massive random passcode. It takes a lot of brainpower to come up with the password, just as it takes a lot of computing power to generate a hash, not to mention the competition of many other miners trying to do the same thing.

Final Thoughts

While cryptocurrencies are continuing to grow in popularity and thereby in value, many are still skeptical. For starters, as of right now cryptocurrency is being taxed by the IRS as property– which poses a challenge for paying employees such as Adams. There are also concerns on who would be in charge of the digital “wallet” that would be used to pay Adams. Aside from the logistical concerns, Chairman Gary Gensler of the United States Securities and Exchange Commission has started to push for more government enforcement regarding cryptocurrency, describing it as an asset class “rife with fraud, scams, and abuse” due to the lack of protection the service provides.

While the United States seems to be pretty divided when it comes to cryptocurrencies, 26.13 percent of Americans own some form of crypto. On the flip side, other countries such as China have recently outlawed all crypto-related transactions after just being one of the world’s most leading nations in digital currency a couple of years back.

Since cryptocurrencies are unregulated there is nearly no protection for one’s investments. As cryptocurrency rises in popularity amongst politicians, stockbrokers, and investment firms, so does the amount of people that try to take advantage of cryptocurrency for illegal transactions and payment that does not need to be run through the government.

Due to the recent rise in public interest relating to cryptocurrency, there are many factors to consider on whether you want to support cryptocurrency. No matter what you think about it, recent trends suggest that cryptocurrency is going to become intertwined into our everyday lives within the next couple of years– so it is important to understand exactly what it is, its downsides, and how to use it early on.

Bitcoin is on the rise, but so is its negative global impact. Graph via the Cambridge Bitcoin Electricity Consumption Index demonstrating the increase in Bitcoin’s global power demand, nearly doubling in recent years from January 2018 to June of 2021.